Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide, Get Practical GST Course in Delhi, 110001, by SLA Consultants India, New Delhi,

Goods and Services Tax (GST) compliance in India requires businesses to file various returns to report their transactions. Among these, GSTR-1, GSTR-2, and GSTR-3B are essential for businesses registered under GST. Understanding these returns is crucial for smooth tax filing and compliance.

1. What is GSTR-1?

GSTR-1 is a monthly or quarterly return that contains details of outward supplies (sales) made by a taxpayer. It must be filed by every registered taxpayer except composition scheme dealers and input service distributors (ISD).

Key Features of GSTR-1:

- Contains details of invoices, debit-credit notes, and exports.

- Filing frequency depends on turnover:

- Quarterly: Businesses with turnover up to ₹5 crore.

- Monthly: Businesses with turnover above ₹5 crore.

- Due Dates:

- 11th of the next month (monthly filers).

- 13th of the month after the quarter (quarterly filers).

2. What is GSTR-2? (Currently Suspended)

GSTR-2 was meant to be a return for inward supplies (purchases), allowing businesses to claim Input Tax Credit (ITC). However, it has been suspended since 2017 to simplify the compliance process. Instead, taxpayers use GSTR-3B for ITC claims.

3. What is GSTR-3B?

GSTR-3B is a self-declared summary return filed monthly to report sales, purchases, ITC claims, and tax liability. Unlike GSTR-1, it does not require invoice-level details but is essential for tax payment.

Key Features of GSTR-3B:

- Mandatory for all regular GST taxpayers.

- Summarizes total sales, ITC claims, and tax payable.

- Tax liability must be paid before filing.

- Due Date: 20th of the next month (or staggered dates for small taxpayers).

Importance of Filing GSTR-1, GSTR-2, and GSTR-3B

- Ensures compliance and avoids penalties.

- Enables smooth ITC claims and tax reconciliation.

- Helps maintain accurate GST records for audits.

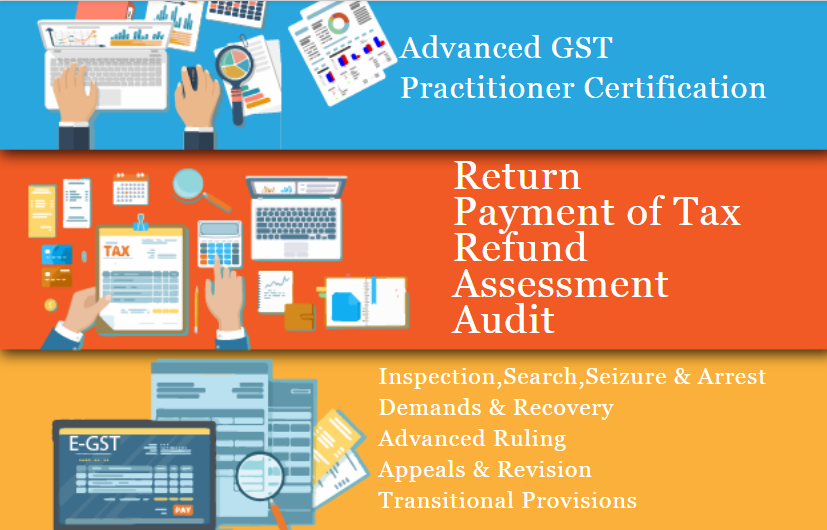

Get Practical GST Course in Delhi by SLA Consultants India

If you want hands-on expertise in GST compliance and return filing, SLA Consultants India offers a Practical GST Training Institute in Delhi in New Delhi (110001).

Course Highlights:

- Live training on GST return filing (GSTR-1, GSTR-3B, etc.).

- Hands-on practice with Tally & Excel.

- Learn GST registration, E-invoicing, and compliance.

- Ideal for accountants, tax professionals, and business owners.

SLA Consultant Understanding GSTR-1, GSTR-2, and GSTR-3B: A Complete Guide, Get Practical GST Course in Delhi, 110001, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar,New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website : https://www.slaconsultantsindia.com/

Leave a Comment